Invoice

The Tax Invoice

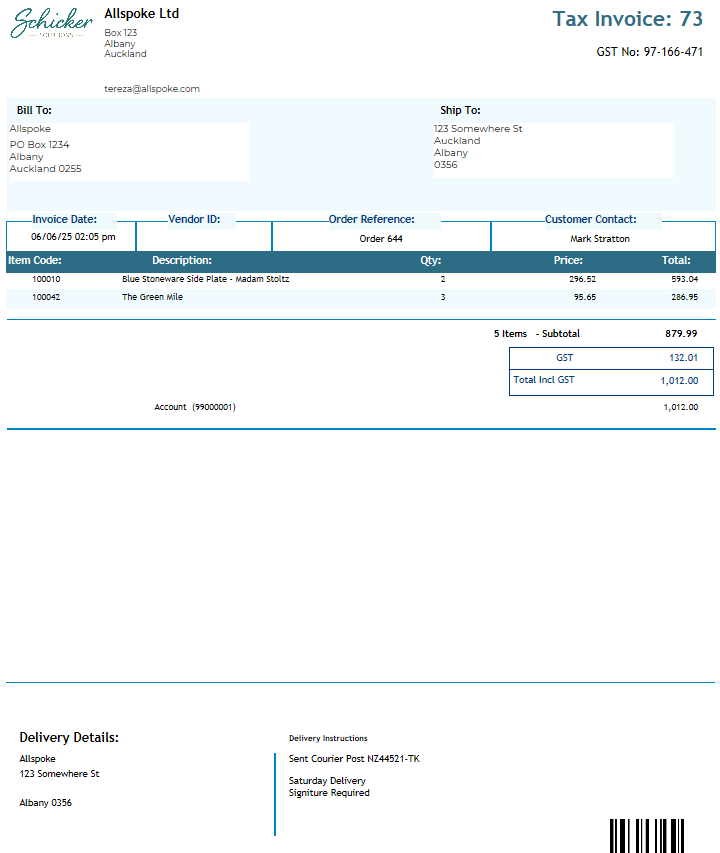

A Tax Invoice is a legal document issued by a seller to the buyer, detailing the goods or services sold, their quantities, prices, applicable taxes (e.g., GST), and the total amount due. It serves both as a request for payment and a record for accounting and tax purposes.

|

Section |

Description |

|

Company Header |

Shows your business name, logo, address, and GST number. |

|

Tax Invoice Number |

A unique identifier for the invoice (e.g. Tax Invoice: 73). |

|

Bill To / Ship To |

The billing address and shipping address of the customer. |

|

Invoice Details |

Displays: |

|

Items Table |

Lists all sold items with: |

|

Totals Summary |

Summarizes the total amounts: |

|

Account Number |

The customer’s account number (e.g. 99000001). |

|

Delivery Details |

Shows shipping address and Delivery Instructions (pulled from DelivInst), formatted to support multiple lines. |

|

Barcode |

Used for fast document retrieval or warehouse scanning. |

Notes

The GST Number appears prominently to ensure compliance with tax laws.

Delivery Instructions are maintained in their original multiline format for clarity.

This document serves as the official proof of sale and must be retained for accounting.