Debtor Movement

Debtor Movement Report

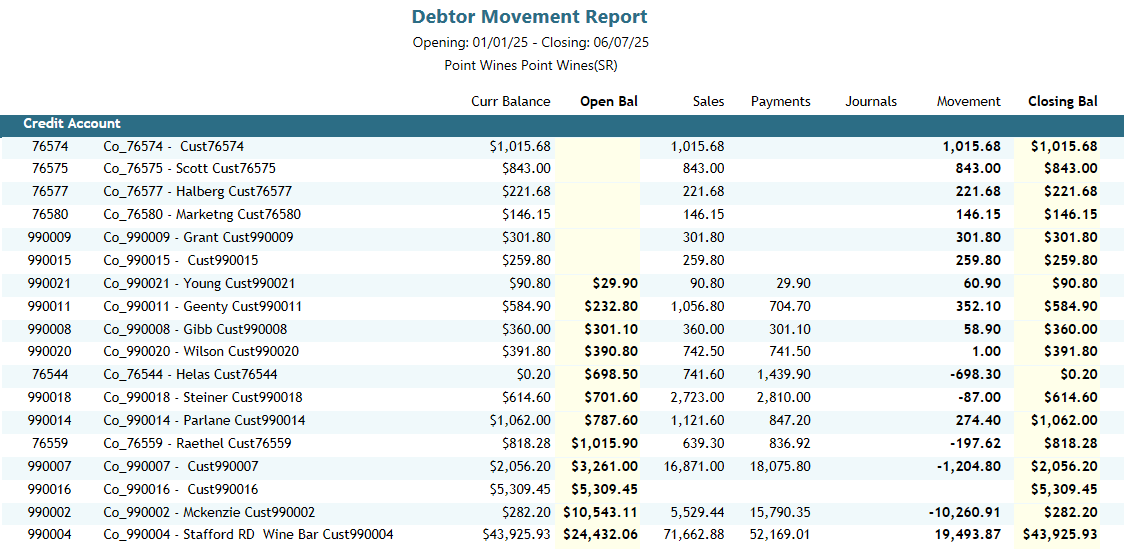

The Debtor Movement Report provides a consolidated view of customer account activity over a specified period. It is essential for understanding how each customer's balance has changed due to sales, payments, and journal entries.

This report helps businesses track financial interactions with customers and ensures accounts receivable are accurate and up to date.

By default, the report is presented on screen, where you can:

Review totals and account-level detail

Print the report directly

Email it as an attachment

Save it in the following formats:

Text (.txt) – For importing into other systems or lightweight reference

PDF (.pdf) – Ideal for archiving or sending to external parties

Excel (.xlsx) – For further analysis, filtering, or integration with other reports

Report Layout

Each line in the report typically includes the following fields:

Customer Code

Customer Name

Opening Balance (as at the start of the selected date range)

Invoices – Total invoiced to the customer during the period

Payments – Total payments received from the customer

Credits / Adjustments – Includes credit notes or manual adjustments

Closing Balance – The net balance at the end of the period

Using the Report

Account Reconciliation – Quickly identify customers with outstanding balances or overpayments.

Credit Control – Use closing balances to identify overdue accounts for follow-up.

Performance Review – Assess customer activity volume over a period (e.g., monthly, quarterly).

Audit Support – Ideal for providing auditors or accountants with a clear view of account movements.

Tips

For best results, ensure all receipts and invoices are up to date before running the report.

Exporting to Excel allows further breakdown, charting, or combining with sales or CRM data.

You may wish to run this report alongside an Aged Trial Balance or Statement run to compare totals and overdue accounts.

Usage Example

A finance officer runs this report monthly to review all account movements and follow up with overdue customers. If a customer shows high sales but no payments, they may be flagged for credit hold or contacted for follow-up.